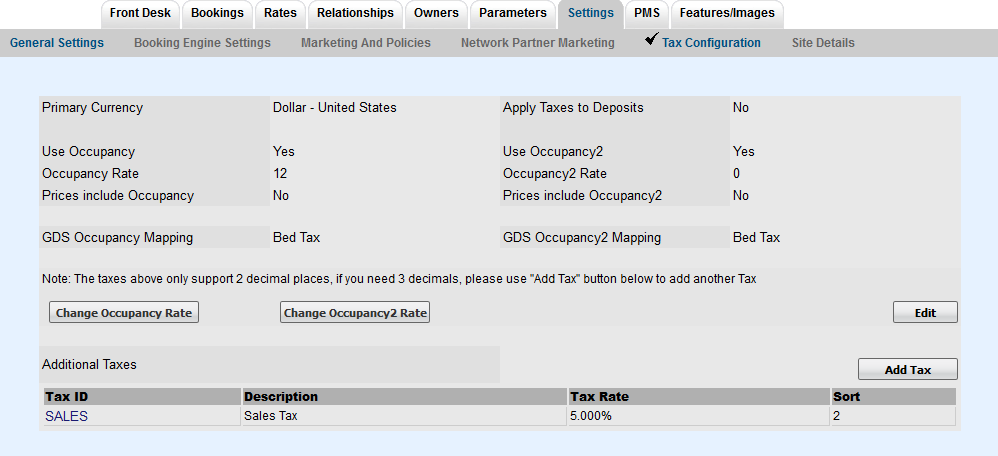

To add or modify your taxes, go to SETUP | SETTINGS | TAX CONFIGURATION. Additional taxes can also be added and applied to Room Rent and/or applied to inventory items. This is useful for flat fees or sales tax on inventory items. See instructions below. To change the name of your taxes, go to Custom System Labeling. - Click Add Tax

- Add a unique Tax ID followed by a brief description.

- Choose a flat rate or a percentage rate.

- Enter the rate as a number. For example, enter 15 if you have a 15% tax rate

- Select whether this tax will be applied on top of other taxes.

- Choose yes or no for the Nonrecurring Tax. This is used if the tax is applied each day of the stay or only on the total.

- If you want this tax to automatically calculate on the Room Rent. Go to SETUP | PARAMETERS | INVENTORY ITEMS. Choose Room Rent and click on the Item ID to open it. Click Edit and go to bottom of page. Click apply tax.

|