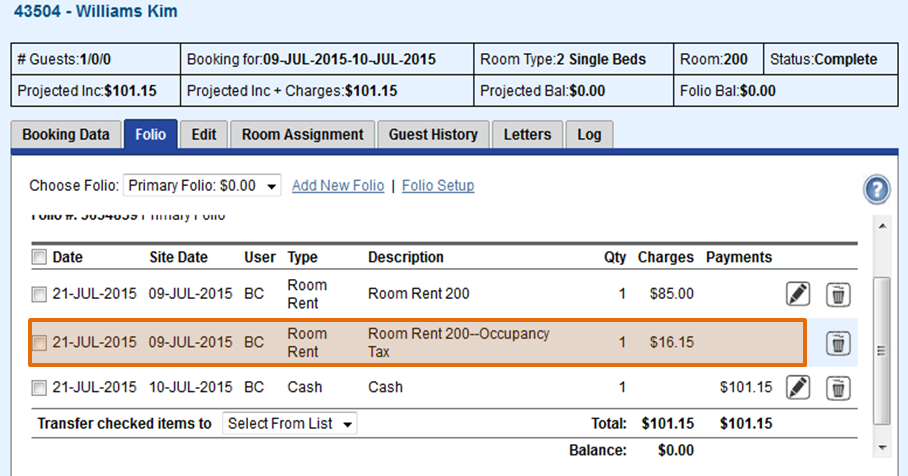

Now configure the taxes that you just named in System Labels. You will see the label you entered for your Primary and Secondary taxes appear here. For example, if you entered "Occupancy", then the label in the Tax Configuration will read "Occupancy Tax".

There are two main taxes, the Primary and Secondary tax. When these taxes are enabled, tax is automatically calculated on room rent in bookings and posted to guest folios.

You can enable one or both of the Primary and Secondary taxes depending on your needs. If you have either Primary or Secondary Tax enabled, the values of these fields will automatically populate the RENT item and taxes will be calculated and posted to the guest folio when room rents are posted. It is critical that your primary and secondary tax fields are using the correct values for your business.

Additional taxes can be added later in MyPMS and applied to Room Rent and/or applied to inventory items. This is useful for flat fees or sales tax on inventory items.

To change the name of your taxes, go to Custom System Labeling.

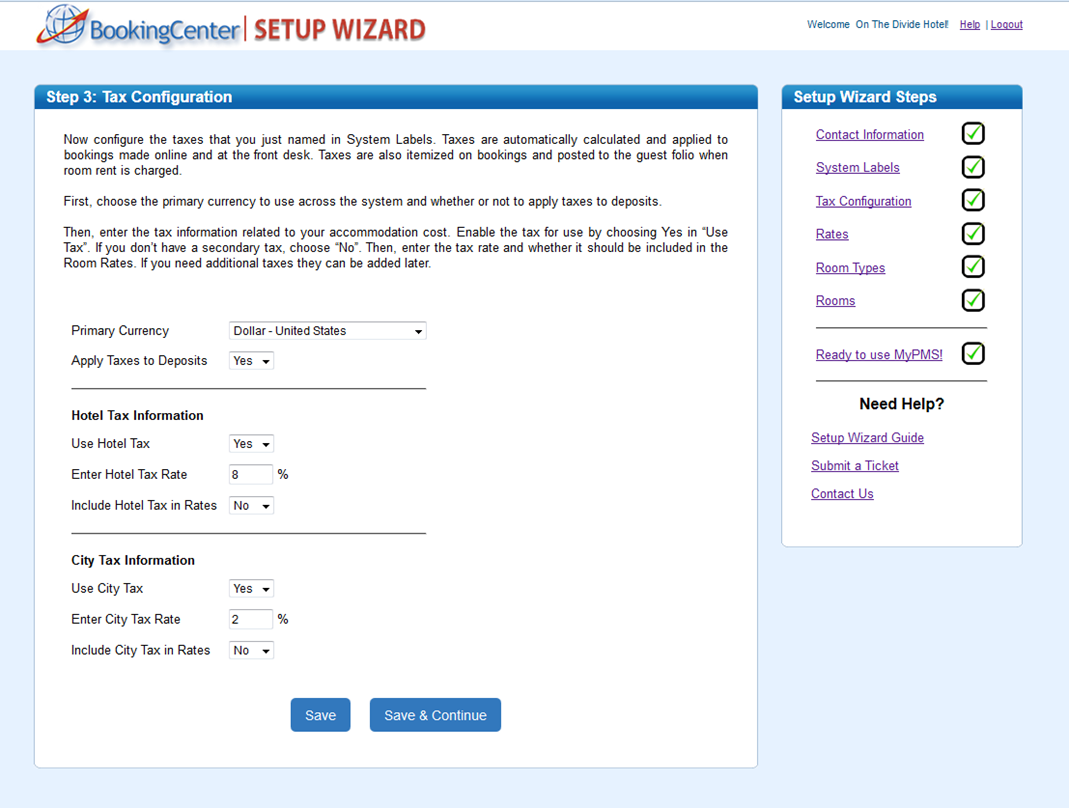

Complete Step 3 - Tax Configuration

- Primary Currency: Choose the currency you will use in your daily operations. This will be used in MyPMS and on guest bookings.

- Apply Tax to Deposits: This is applicable only on the Booking Engine (Not through GDS or OTA connections). To calculate taxes on deposits taken for online bookings on your website, choose "Yes".

- Tax Settings for Primary and Secondary Taxes: Note, If you do not have Secondary Tax, then choose Use Tax, "No".

- Use [Tax Name] Tax: Do you want to use this tax? Choose "Yes or No". To enable this tax to automatically calculate on room rent for guest bookings and folio charges, choose "Yes".

- [Tax Name] Tax Rate: The tax rate is displayed as a number representing the percentage, i.e.. 19 is a 19% tax rate. To edit the tax rate, go to the next step

- Prices include [Tax Name] Tax: Do you want the Room Rates to include Tax? Choose "Yes or No". To itemized your Room Rent and Taxes and have Rates appear without tax included, choose "No".

Click image to enlarge